TUNESS Chart of the Week (TCW), Friday Feb 8, 2013

External debt is defined as the portion of the gross (total) debt in a country that is owed to creditors outside the country. It consists of two main components: long-term debt and short-term debt. The long-term debt is the sum of the private non-guaranteed (PNG) and the public & publicly guaranteed (PPG) debts.

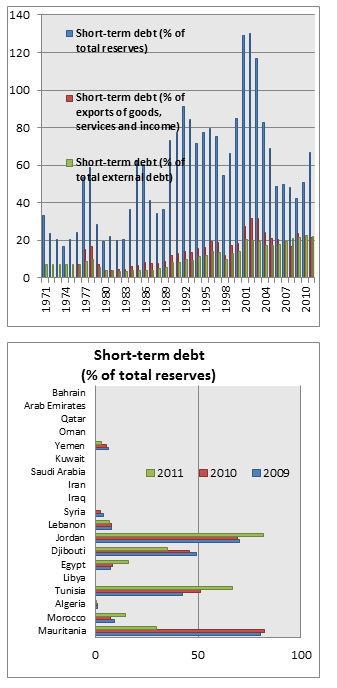

According the World Bank, the present value (as of 2011) of the external debt of Tunisia is 19,214,827,380 US dollar, i.e., 19.2 Billion dollars, 22.24% of which is short-term. As of 2011, the Tunisian external debt represents 48.69% of the Gross Domestic Product (GDP), and 50.44% of the Gross National Income (GNI), and 85.42% of the exports of goods, services and primary income. Particularly, we focus in this note on the short-term debt given the challenge it represents to the country's liquidity, solvability and the pressure it puts on the foreign reserves of the country. The first chart above displays Tunisia's short term debt (% of the total reserves) from 1971 until 2011. It is clear from the chart that the debts were escalating during the last three years. In fact, it went from 42% in 2009 to 66% in 2011.

According the World Bank, the present value (as of 2011) of the external debt of Tunisia is 19,214,827,380 US dollar, i.e., 19.2 Billion dollars, 22.24% of which is short-term. As of 2011, the Tunisian external debt represents 48.69% of the Gross Domestic Product (GDP), and 50.44% of the Gross National Income (GNI), and 85.42% of the exports of goods, services and primary income. Particularly, we focus in this note on the short-term debt given the challenge it represents to the country's liquidity, solvability and the pressure it puts on the foreign reserves of the country. The first chart above displays Tunisia's short term debt (% of the total reserves) from 1971 until 2011. It is clear from the chart that the debts were escalating during the last three years. In fact, it went from 42% in 2009 to 66% in 2011.

The second chart compares the short-term debt of Tunisia (% of total reserves) to the rest of the countries in the Middle East and North Africa (MENA) region. Tunisia is the 10th largest country in population in the MENA region, and has the 11th largest GDP per capita. When it comes to short-term debt, 9 out of 20 MENA countries are debt free. According to the numbers displayed in the second chart, Tunisia is one of the top indebted countries within the MENA region. In fact, it went from the fifth top indebted country within the MENA region in 2009, to the fourth in 2010, and reached the 3rd position in 2011.

(Chart prepared by TUNESS Research Team), Data source: IMF and World Bank