TUNESS Chart of the Week (TCW), Monday April 22, 2013

Like most emerging economies, Credit market in Tunisia continues to absorb the bulk of domestic financing needs from both public and private sectors. Despite several past attempts to boost the domestic capital market through successive waves of financial liberalization, the latter has failed to impose itself as a major player in the local financial market. As a result, credits are currently (by far) the major source for funding domestic investments and private consumption and thus the main driving force of the economic growth (at least at the aggregate level).

Following the last revolution and the growing fear surrounding the health of the banking sector as the latter continues to accumulate non performing loans jeopardizing its fundamentals, (coupled with the continuing rise of inflationary pressures), local authorities have started, albeit gradually, tightening the monetary policy and putting some constraints on the lending policy of the banking sector.

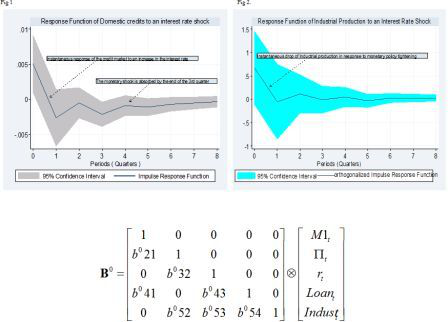

In this note, we estimate, using a simple recursive structural vector autoregressive model (constructed in a matrix form as shown below), the main channels and intertwined (endogenous) relationships through which credits market reacts to certain monetary policy shocks and in return impacts the economic activity in the Tunisia. The present methodology is widely used in the literature that has studied similar theoretical frameworks in both emerging and developed economies (Leeper, Sims and Zha, 1996; Berkelmas, 2006; and Davoodi, Dixit and Pinter, 2013, etc.). We follow Berkelmas' (2006) suggestions to use a relatively simple and parsimonious model which, according to the author: “is likely to be easier to estimate and more stable”.

We mainly focus on the results of the impulse response functions in order to analyze the empirical effects of the Tunisian authorities’ interventions to mitigate the current inflationary pressures in the country.

In the matrix above, let Industt denotes the log of industrial production index, rt denotes the nominal money market rate as the main instrument of the Central Bank’s monetary policy, Loant is the total amount of the private bank credits, πt is the log of the inflation rate and M1t is the log of the total amount of money (M1) in the economy. The coefficients bij reflects the contemporaneous impact of variable j on variable i. The time series included in this study are quarterly and cover the period from 1993:Q1 through 2012:Q2.

Following standard approach in the literature to estimate the appropriate lag length (e.g., AIC, SIC,.. ), we chose a lag length of two (relevant test can be shared upon request).

While more in-depth analysis and detailed explanations of the model will be presented in an upcoming research paper published by TUNESS, in this note we review one aspect of the above mentioned endogenous relationship which is highly relevant to the current economic situation in Tunisia. The reaction function of the banking institutions (through the credit channel) to a monetary policy shock and its impact on the economic activity prospects over the short run is undoubtedly of a great importance for both policymakers and local agents. Asymmetric information and imperfections in financial markets provide very often a strong basis for this credit channel, defined by certain authors as (a) the bank-lending channel; and (b) the balance sheet channel.

As shown in the matrix above, the model highlights 3 main macroeconomic relationships;

(a) The Money supply in the economy is exogenous (only impacted by other macroeconomic shocks with certain lags;

(b) The Tunisian monetary authorities set their main monetary instrument (short term interest rate) as a function of the current inflation pattern. This policy is in accordance with the Tunisian central bank's mandate as set forth in the last legislation adopted in 2007defining price stability as the main target of the monetary policy along with economic sustainable growth. The monetary authorities are also assumed to react to past movements of the other macroeconomic variables with lag (Taylor rule) including past credit growth;

(c) The bank loans is assumed to respond instantly to a contractionary monetary policy (e.g., an exogenous rise of money market rate) but tend to lag any fluctuations in the business cycle.

All above relationships have a strong empirical support in the literature (thoroughly reviewed in the upcoming research paper). Additionally we assume that local inflation has a contemporaneous monetary origin resulting from an increase in the monetary base. Finally economic activity seems to react instantly to demand shocks generated by either an increase in the price levels (which in the short run (in an imperfect information model) may signal a surge in the domestic demand and thus could boost investment and growth) or a change in the credit policy (e.g., credit rationing or credit easing) and the monetary shocks. The last assumption is in line with the model developed by Berkelmas (2006). Very often in the literature, the major empirical challenge is to disentangle the effects of these two shocks from the main transmission channel of the monetary policy.

Figure 1 shows the impulse response function of the bank loans to a monetary policy shock that’s to structural interest rate shock. According to the chart, a decision by local authorities to tighten the monetary policy in response for example to an increase in the inflationary pressures appears to lead to an instantaneous drop in the amount of the bank loans to the private sector. This reaction in turn is expected to slowdown the economic activity as most domestic investment are financed through the credit market as well as household durable goods. The initial shock is reversed starting from the second quarter and seems to be totally absorbed by the end of the third quarter as the total amount of credits get roughly back to its baseline before the shock. This finding confirms previous empirical studies that provided strong evidence of a weak interest rate pass-through.

As monetary authority continues to actively attempt to mitigate the persistent prospects of price increase through gradual tightening of monetary policy, the amount of total loans available for domestic economic agents is expected to maintain its downward slope as the cost of capital increases. As stated above, this scenario will have as inevitable consequences to constrain the domestic investment and thus the economic activity at least over the short run. As shown in Fig 2, the industrial production appears to be negatively and instantly affected by the an increase of the interest rate through various channels outlined above (credit channel but also (not described in this note) Asset price Channel, Expectation Channel and exchange rate channel).

We have presented here a brief empirical contribution to shed some light on the endogenous relationship between the monetary policy and the credit market. We have also flagged the short run impact of potential contractionary intervention of the local authorities, in response to the inflationary pressures, on the aggregate economic activity. This contribution is by no means an exhaustive analysis and should only be seen as a preliminary theoretical attempt to scratch on the surface of the critical and much wider issue of understanding the transmission mechanisms of the monetary policy in Tunisia.

Note prepared by Bechir Bouzid, PhD, TUNESS Research Team

References;

Berkelmans, L., (2005): “Credit and monetary policy : an Australian SVAR”. Research Discussion Paper, 005-06. Reserve Bank of Australia.

Davoodi, H., Dixit, S., and Pinter, G. (2013): “Monetary Transmission Mechanism in the East African Community : An Empirical Investigation ”. IMF Working Paper , WP/13/39

Leeper, E., Sims, C., and Zha, T. (1996): “What does Monetary Policy Do?”. Brookings Papers on Economic Activity 1666:2.